Average deductions from paycheck

Medicare and Social Security are required deductions by the federal government. These deductions are remitted to us along with your employers share of premiums through payroll remittances.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

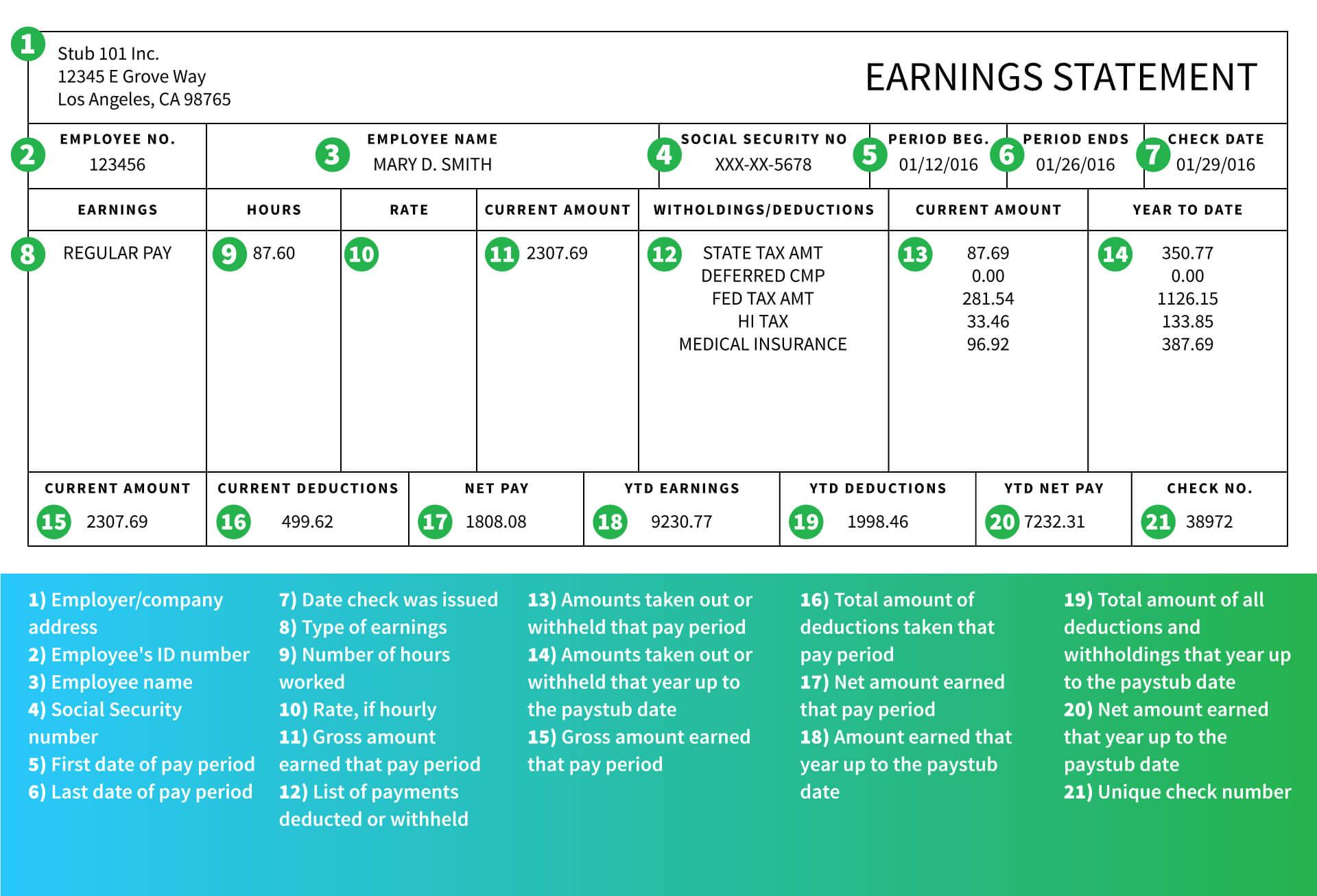

Payroll deductions occur when your employer withholds from your paycheck for involuntary or voluntary reasons including taxes and benefits programs.

. Yearly after all the taxes are paid for the take-home paycheck is 21597 in total. Starting with the pay period in which an individuals earnings exceed 200000 you must begin deducting 09 from his or her wages until the end of the year. You need to save 5 of every paycheck if you start at age 25.

For example according to the chart the average American with AGI of 80000 can be expected to take a 3244 charitable deduction. So if you deduct 3500 worth of. To get information on EI benefits go to EI Regular Benefits Overview.

For example if an employee earns 1500 per week the individuals. You need to save 10 if you start at age 35 22 if you start at age 45 and 52 of every paycheck if you start at. Based on a survey of 2100 employees at non-federal public and private companies KFFs 2017 Employer Health Benefits Survey finds that the average worker pays 5714 toward.

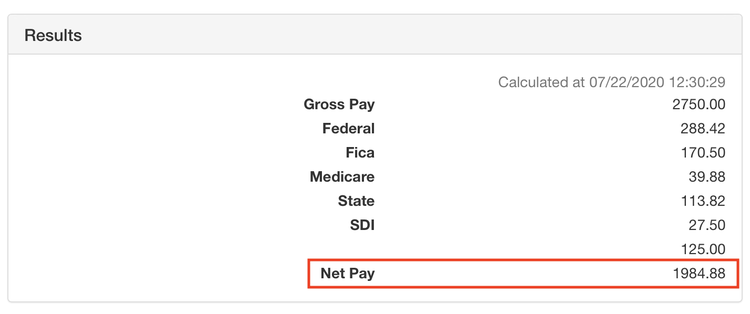

Paycheck Tax Calculator Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. On average 82 percent of single-person insurance policy premiums are employer covered. Your taxes are estimated at 11139.

You can enter your current payroll information and deductions and. The government will determine how much you owe based on the amount of. Understanding paycheck deductions Income tax If you are an employee you will have to pay income taxes.

The Social Security tax is 62 percent of your total pay until you. Of course each business will have. As of 2013 there is an.

These include Roth 401k contributions. For instance if you get paid bi-weekly and are a full-time hourly. Both employer and employee pay 145 of gross income into the system on the employees behalf and it provides coverage for major medical expenses.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541 Social Security Medicare Income tax. 10 on the first 9700 970 12 on the next 29774 357288 22 on. That number drops to 71 percent for family plans.

Additional Medical Tax also. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your income puts you in the 25 tax bracket.

Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income. This means the total percentage for tax. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

This is 1547 of your total income of 72000. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. You can deduct the most common personal deductions to lower your taxable.

Therefore the total amount of taxes paid annually would be 4403. This will help determine your withholding when completing a W-4. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

1547 would also be your average tax rate. For 2011 employees deduct 42 percent of their paycheck to go toward Social Security. Gross pay is the total earning before any deductions.

The money for these accounts comes out of your wages after income tax has. Some deductions from your paycheck are made post-tax. Taxpayers can choose either itemized deductions or.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Understanding Your Paycheck Credit Com

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

A Small Business Guide To Doing Manual Payroll

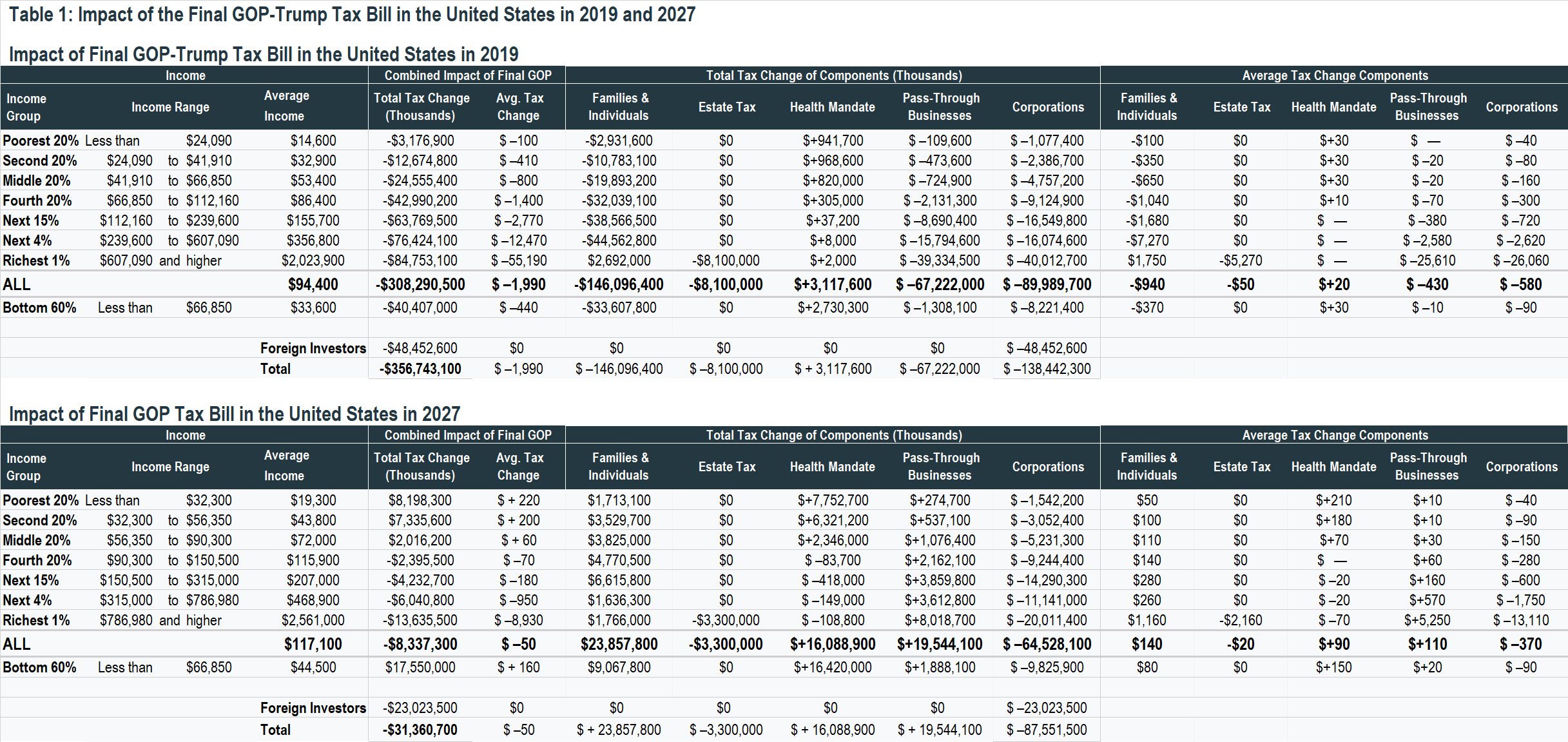

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

The Real Numbers In Your Paycheck Southpoint Financial Credit Union

Here S How Much Money You Take Home From A 75 000 Salary

Different Types Of Payroll Deductions Gusto

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Pay Stub Meaning What To Include On An Employee Pay Stub

Check Your Paycheck News Congressman Daniel Webster

How To Read A Pay Stub Gobankingrates

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck